Corporate Finance Institute – Analyzing Growth Drivers & Business Risks

$997.00 $27.00

Total Sold: 1

Delivery: Instant Delivery

Description

Corporate Finance Institute – Analyzing Growth Drivers & Business Risks

Kickstart your business or finance journey by unpacking how macro, industry, and firm-level characteristics can influence business decisions.

- Understand how growth drivers and business risks are key parts of financial analysis

- Explore widely-used qualitative analysis frameworks

- Leverage qualitative analysis techniques to inform financial model assumptions

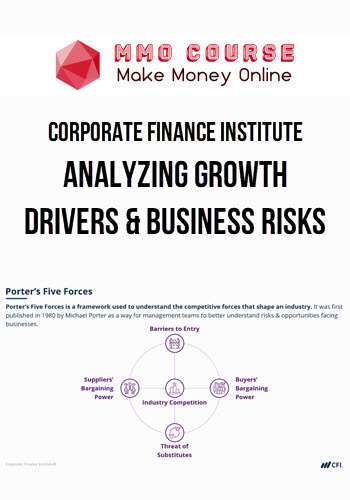

Understanding growth drivers and business risks are essential parts of analyzing a business or in formulating a solid corporate strategy. This can be achieved using a top-down approach, by first looking at the broader economy, followed by industry analysis, then at the company itself; this course introduces frameworks to assess each level in specific detail. We’ll look at how to conduct a PESTEL analysis before diving into the Porter’s 5 Forces framework to help understand the bargaining power of suppliers and of buyers, as well as the threat of new entrants.

We’ll also explore the industry life cycle, competitive advantage and positioning, as well as Ansoff’s Matrix, before completing a SWOT analysis. Finally, we’ll work on two example case studies to demonstrate how the findings from these frameworks might help inform an analyst’s model assumptions.

This course is perfect for beginner and intermediate business and finance enthusiasts, including aspiring financial analysts, management consultants, and entrepreneurs.

What You’ll Learn In Analyzing Growth Drivers & Business Risks?

- Define key categories of growth drivers and business risks

- Compare different business analysis frameworks

- Define how economic, industry and company-level characteristics may influence business strategies and outcomes

- Interpret the results of qualitative assessments

- Explain how these results may inform financial analysis

Sale Page: Corporate Finance Institute – Analyzing Growth Drivers & Business Risks

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to MMOCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your mmocourse.hk account then going to Downloads Page.

Related products

Total sold: 2