Corporate Finance Institute – Accounting Principles and Standards

$997.00 $27.00

Delivery: Instant Delivery

Description

Corporate Finance Institute – Accounting Principles and Standards

Understanding specific accounting principles and standards is a necessary aspect to becoming a world-class financial professional

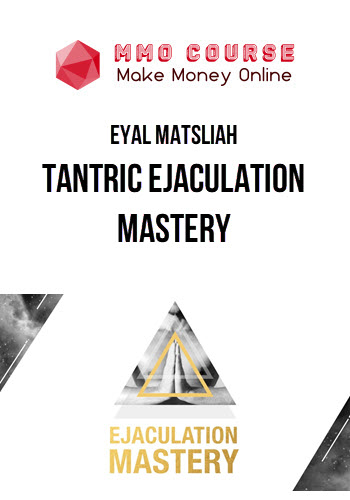

- Understand the fundamental accounting principles that underly more detailed accounting standards

- Gain an understanding of revenue recognition and its associated matching principle

- Identify the key standards relating to leases, income taxes, business combinations, and more

This course is designed to give some background on the fundamental accounting principles that underlie accounting standards and explore in more depth, some of the specific accounting standards commonly encountered by financial analysts. A good understanding of accounting standards is essential for reading and interpreting financial statements and in creating robust financial models.

This Accounting Principles and Standards course covers the foundational knowledge every financial analyst should understand to perform sound financial reporting and analysis. Anyone who would like to start a career in investment banking, financial planning and analysis (FP&A), corporate development, equity research, and other areas of corporate finance should take this course to reinforce their accounting knowledge.

What You’ll Learn In Accounting Principles and Standards?

1.Understand the fundamental accounting principles that underly more detailed accounting standards

2.Understand why it is important to have as well as the characteristics of useful financial information

3.Explain the common accounting standards that financial analysts frequently encounter, such as:

- Accrual basis of accounting

- Revenue recognition principle

- Historical cost principle

- Matching principle

- Materiality principle

- Conservatism principle

- Full disclosure principle

4.Identify the key standards when accounting for leases, incomes taxes, share-based payments, business combinations, and transactional costs

Sale Page: Corporate Finance Institute – Accounting Principles and Standards

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to MMOCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your mmocourse.hk account then going to Downloads Page.

Related products

Total sold: 1

Total sold: 4