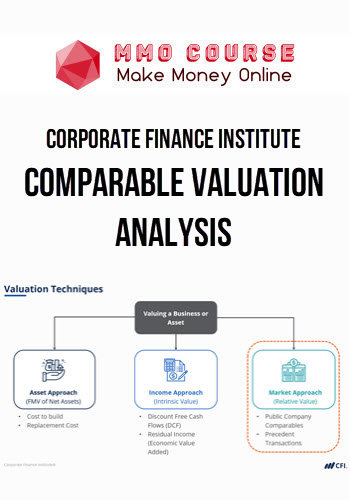

Corporate Finance Institute – Comparable Valuation Analysis

$997.00 $27.00

Total Sold: 1

Delivery: Instant Delivery

Description

Corporate Finance Institute – Comparable Valuation Analysis

Learn how to perform a Comparable Valuation Analysis to help “triangulate” the value of a company, asset, or investment.

- This course covers both Comparable Trading valuation as well as Precedent Transaction valuation

- Discover how to screen for public company peers as well as relevant, recent transactions

- Calculate the enterprise value and equity value of a target company, using real public companies and recent precedent transactions

Understanding valuation is one of the most fundamental and crucial skills to master as a finance professional. This course focuses on comparable valuation analysis, one of the most widely used valuation techniques. During this course, we cover how to screen for publicly traded comparable companies and precedent transactions.

We will also discuss different types of multiples and nuances when entering actual, real-world company data. After completing this course, you will understand how to value a company using multiples, and the advantages and disadvantages of comparable company analysis.

This course is most suitable for anyone working in valuation, including investment banking, equity research, private equity, and corporate development.

What You’ll Learn In Comparable Valuation Analysis?

- Understand relative valuation versus other valuation methodologies.

- Recognize the advantages and disadvantages of relative valuation.

- Determine how to pick comparable companies and precedent transactions.

- Match enterprise value and equity value with appropriate metrics.

- Identify debt and debt equivalents as well as cash and other non-operating assets.

- Find and enter the applicable data using real-world examples

Sale Page: Corporate Finance Institute – Comparable Valuation Analysis

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to MMOCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your mmocourse.hk account then going to Downloads Page.

Related products

Total sold: 1