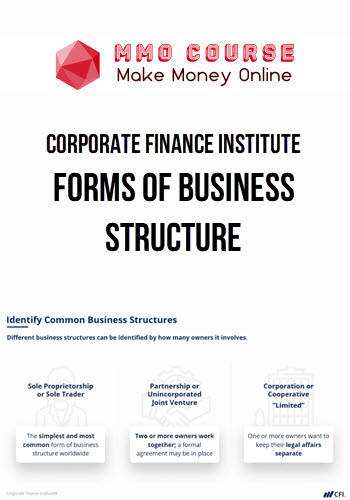

Corporate Finance Institute – Forms of Business Structure

$997.00 $27.00

Delivery: Instant Delivery

Description

Corporate Finance Institute – Forms of Business Structure

Navigate the business world confidently by understanding various forms of business structure and their implications on borrowing

It is important to differentiate the types of business structures and make appropriate credit decisions based on the business’s risk and owners’ liability. This course introduces three of the most common business forms: sole proprietorships, partnerships, and corporations.

We also cover other business forms, including C and S Corporations, limited liability companies (LLC), franchises, nonprofit organizations, and cooperatives. By the end of this course, you should have a thorough understanding of the similarities and differences between forms of business structures, as well as each structure’s liabilities, rights, and limitations. We will also look at scenarios where business structures can affect how an analyst makes decisions in the lending process.

This course is perfect for aspiring or early-stage credit professionals, including business and commercial bankers, credit analysts, real estate lenders, equipment finance, loan & mortgage brokers, and other private (non-bank) lenders.

What You’ll Learn In Forms of Business Structure?

- Understand why business structures exist

- Identify common business structures

- Compare the different business structures and consider their advantages and disadvantages

- Highlight each structure’s liabilities, rights, and limitations

- Consider how a business structure can affect the lending process

- Determine suitable business structures for different scenarios

Sale Page: Corporate Finance Institute – Forms of Business Structure

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to MMOCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your mmocourse.hk account then going to Downloads Page.

Related products

Total sold: 2

Total sold: 5