Corporate Finance Institute – Loan Default Prediction with Machine Learning

$997.00 $27.00

Delivery: Instant Delivery

Description

Corporate Finance Institute – Loan Default Prediction with Machine Learning

Combine a data set with basic Machine Learning skills to predict which customers are likely to default on their loans.

Machine Learning is about making predictions using data. In this course, you’ll learn to use basic Machine Learning skills to predict which customers are likely to default on their loans.

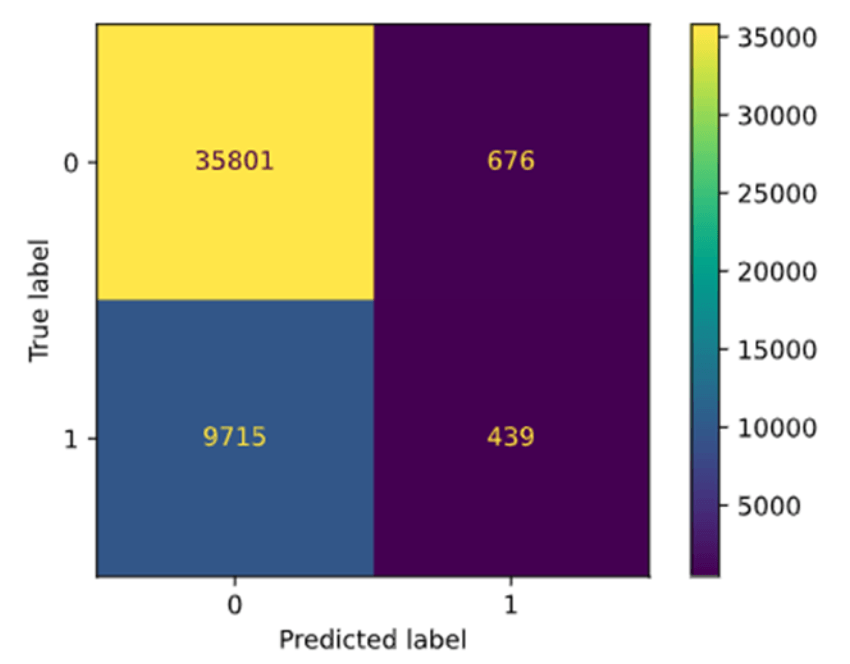

Once your model classifies each loan, you’ll learn to visualize your predictions to see how well the model performed.

Predicting defaults and creditworthiness is hugely valuable to risk management and pricing decisions.

We will cover the entire Machine Learning process in Python, reinforcing concepts from Python fundamentals. You’ll learn how to create predictive classification models, fine-tune and test your process, and how to interpret the results.

Machine Learning is a hot topic in the world of data, particularly data science. At a basic level, Machine Learning is not as complex as it may sound. If you’ve ever done linear regression, you may be surprised to learn that you’ve already taken steps toward this exciting world.

Join Andrew for a comprehensive step-by-step walkthrough of the Machine Learning process.

The Machine Learning cycle is one of the most foundational aspects of Data Science. Using this process, we can learn to make predictions using all types of data and variables. Anyone looking to make predictions in a practical Python environment should absolutely be doing this course.

What You’ll Learn In Loan Default Prediction with Machine Learning?

- Explain and discuss the main steps of the Machine Learning cycle

- Load and clean data into a python notebook

- Use Exploratory Data Analysis to identify variables with likely predictive power

- Use Feature Engineering to transform data into a more useful format

- Build a logistic regression and random forest prediction model

- Evaluate and compare model performance using common evaluation metrics

Sale Page: Corporate Finance Institute – Loan Default Prediction with Machine Learning

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to MMOCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your mmocourse.hk account then going to Downloads Page.