Corporate Finance Institute – Mergers & Acquisitions (M&A) Modeling

$997.00 $27.00

Total Sold: 1

Delivery: Instant Delivery

Description

Corporate Finance Institute – Mergers & Acquisitions (M&A) Modeling

Learn advanced financial modeling techniques and transaction analysis for mergers and acquisitions (M&A).

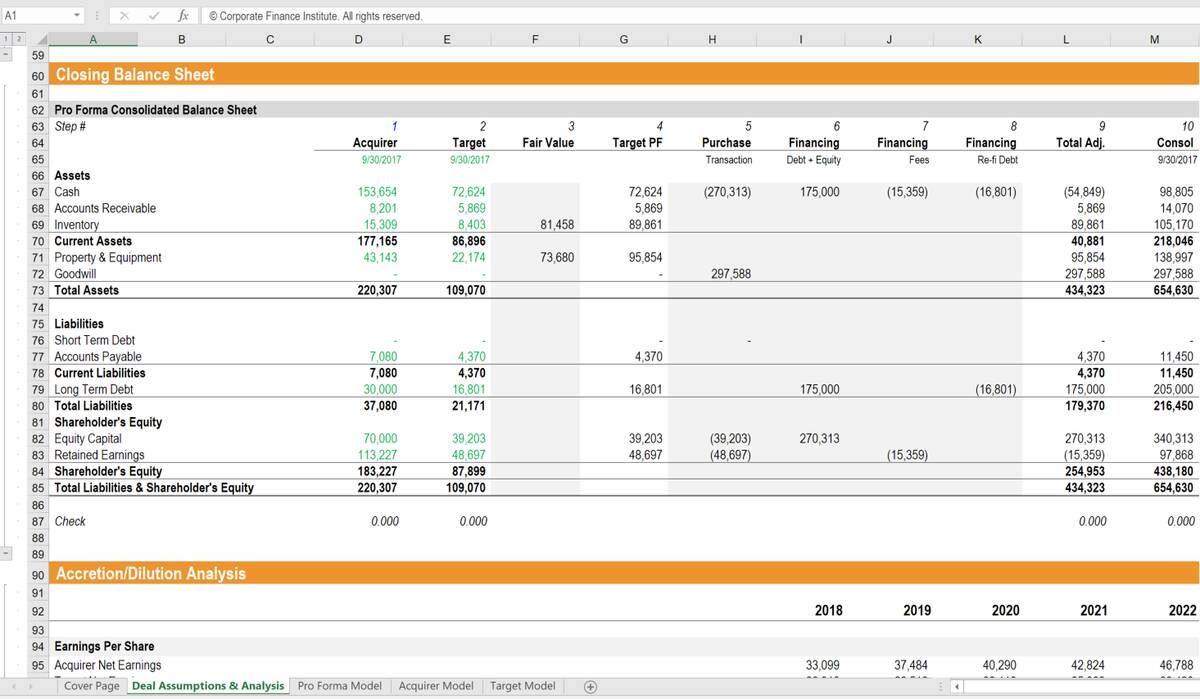

- Integrate target companies’ financial statements with the acquirers’, including making the proper transaction-related adjustments

- Evaluate deals by calculating accretion/dilution of earnings per share and cash flow per share

- Value combined entities using DCF models

Welcome to CFI’s advanced financial modeling course on mergers and acquisitions (M&A). This course is designed for professionals working in investment banking, corporate development, private equity, and other areas of corporate finance that deal with analyzing M&A transactions.

This class is perfect for anyone who wants to learn how to build a financial model for mergers and acquisitions from the bottom up. The video-based lessons will teach you all the formulas and functions to calculate stub periods, outline sources and uses of cash, perform a purchase price allocation and determine goodwill, create multiple scenarios for synergies and other key assumptions, and integrate all of the above into a well laid out pro forma model.

In addition to learning the detailed mechanics of how to build the model, students will also learn how to assess the impact of the transaction through accretion/dilution analysis and the impact on the implied share price (intrinsic value per share). By performing sensitivity analysis, users will understand how a change in assumptions impacts future outcomes of the merger or acquisition.

What You’ll Learn In Mergers & Acquisitions (M&A) Modeling

- The construction of a detailed Pro Forma model

- Analysis of synergies, revenue enhancements, cost structures

- Integration considerations

- Accretion / dilution analysis

- Deal terms and structuring

- The strategic impact of combining the businesses

- Share price impact

Sale Page: Corporate Finance Institute – Mergers & Acquisitions (M&A) Modeling

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to MMOCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your mmocourse.hk account then going to Downloads Page.

Related products

Total sold: 1

Total sold: 3

Total sold: 4

Total sold: 2

Total sold: 5