-

×

Frank Kern – Marketing Vault Hot Products

1 × $128.00

Frank Kern – Marketing Vault Hot Products

1 × $128.00

Buy With Coupon: WEBH5K6 (-30%)

Corporate Finance Institute – Real Estate Financial Modeling in Excel

$997.00 Original price was: $997.00.$27.00Current price is: $27.00.

Total Sold: 1

Delivery: Instant Delivery

SKU: LO45F8J5

Categories: »Instant Delivery, Finance

Tags: Corporate Finance Institute, Real Estate Financial Modeling in Excel

Corporate Finance Institute – Real Estate Financial Modeling in Excel

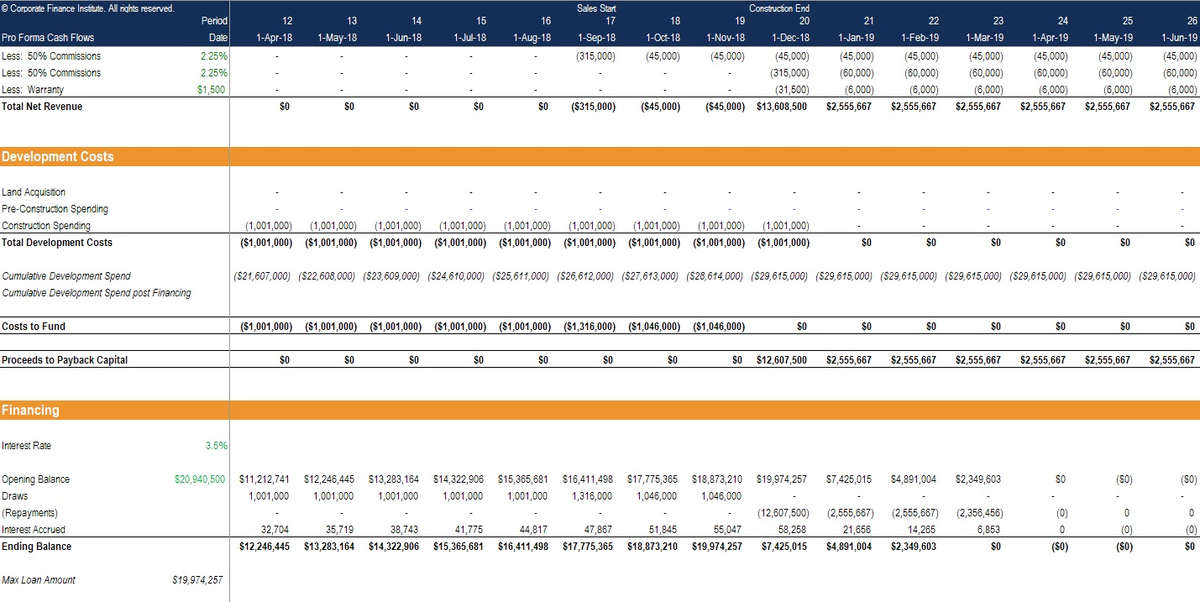

This course covers the language of the real estate industry as it applies to finance. You’ll walk step-by-step through building a model in Excel and upskill your modeling knowledge.

- Learn the nuances of the real estate industry

- Understand how to project real estate financing at different stages in a project’s life cycle

- Calculate a cash flow waterfall for different investors

Build a dynamic Real Estate Financial model to evaluate the investment return profile of a development project in Excel. This Excel-based real estate financial modeling course is designed for development professionals, lending/banking analysts, surveyors, and anyone interested in mastering the art of building real estate development models from scratch.

In this real estate modeling course, you will learn step-by-step how to build a dynamic financial model that incorporates sensitivity analysis of development costs, sales prices, and other aspects of development.

This real estate development financial modeling in Excel course is designed for anyone who is seeking to develop intermediate to advanced financial modeling skills and become an expert financial modeler for real estate development.

What You’ll Learn In Real Estate Financial Modeling in Excel

- Real estate industry Overview

- Calculate Cap Rate and Net Operating Income (NOI)

- Build an interactive financial model to assess a project’s financial viability

- Understand how to project real estate financing (both debt and equity) flow in and out depending on stage of development

- Design and structure of an Excel-based project finance model

- Modeling cash flows for a real estate development project

- Build in “triggers” and sensitivities to understand a project’s exposure to key drivers

- Develop ownership and financial structures (debt & equity)

- Calculate Internal Rate of Return (IRR), Return on Sales, Return on Cost

- Joint Venture (JV structures)

- Cash flow waterfalls (3 tier cash flow waterfall)

- Promotes and disproportionate returns

- Produce a one-page investment summary memo

- Includes blank and completed financial models to download

Sale Page: Corporate Finance Institute – Real Estate Financial Modeling in Excel

Related products

-85%

»Instant Delivery

Total sold: 5

-97%

»Instant Delivery

Total sold: 3

-80%

»Instant Delivery

-100%

»Instant Delivery

Total sold: 4

-87%

»Instant Delivery

Total sold: 8

-91%

»Instant Delivery

Total sold: 2

-98%

»Instant Delivery

Total sold: 7

-98%

»Instant Delivery